The total profit on Esperio investment portfolios as of October 10, 2024, was $4,372. According to the interim report (for the period from September 5 to October 10, 2024), more than 90% of the total profit was received from gold and NVidia stock transactions. Both transactions are currently closed.

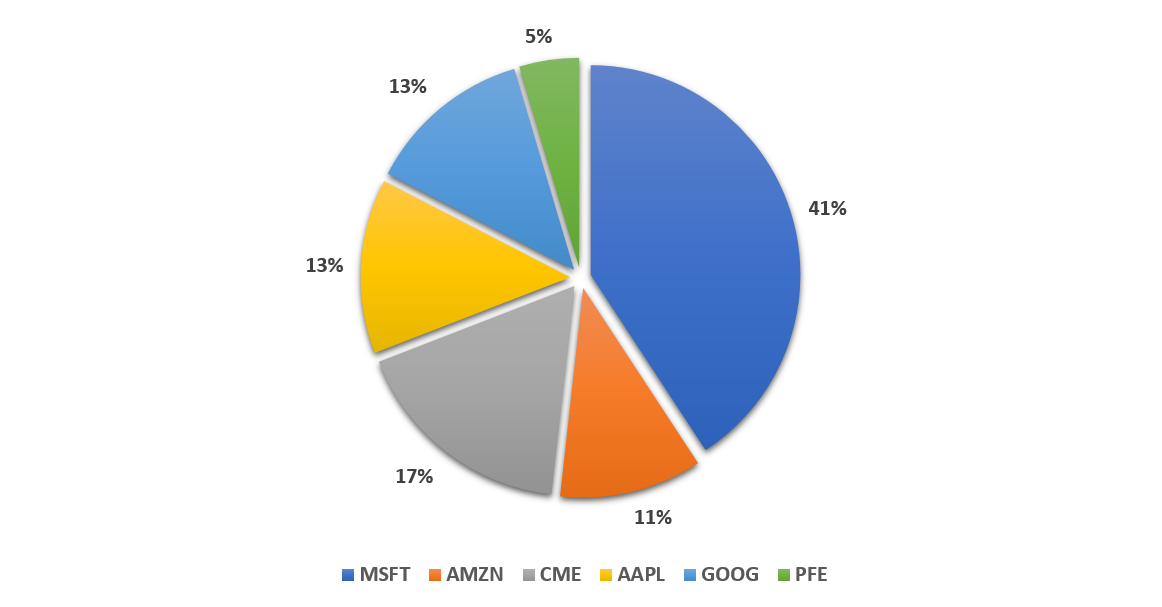

“First Steps” Portfolio

In the First Steps portfolio, the gold transaction was closed with a profit of $571.17, dividends were received on Google ($0.8) and CME Group ($4.6). At the end of the month, the portfolio value increased by 9.46%. The growth potential was 21.7%, and the risk level is at a minimum of 1.5%.

The structure of the investment portfolio "First Steps" as of October 10, 2024.

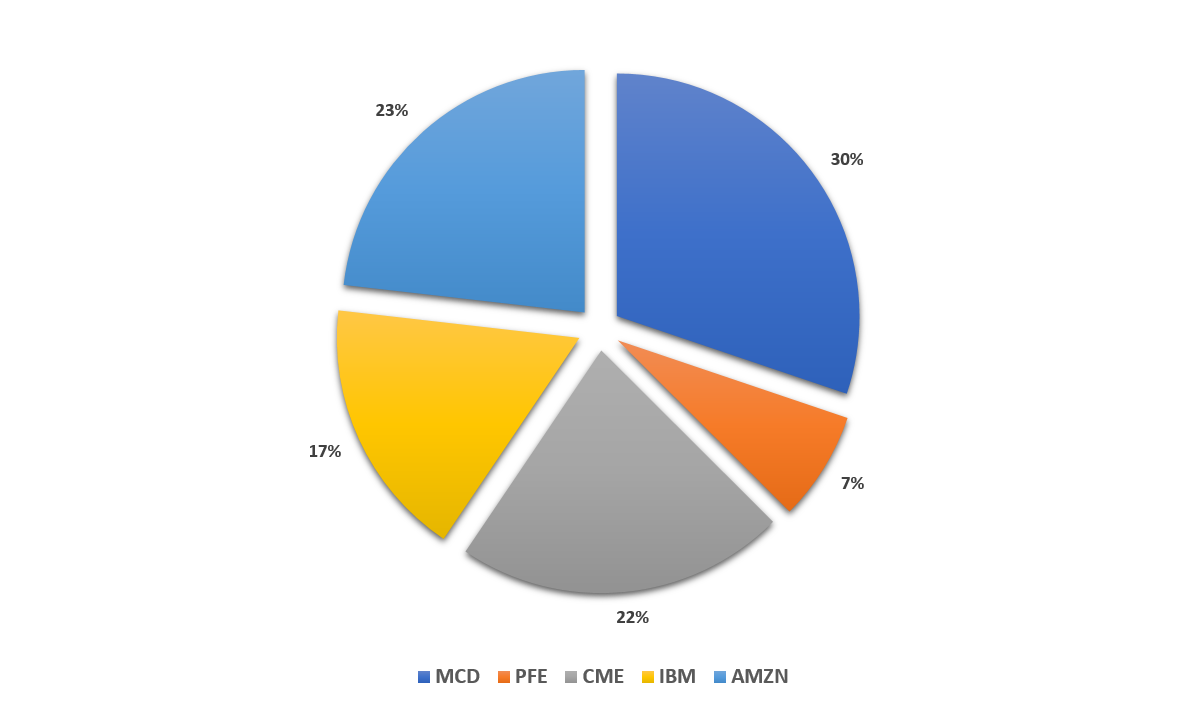

"Optimal" Portfolio

In the portfolio "Optimal", the gold transaction was also closed with a profit of $945.70, dividends were received on CME Group shares ($4.6). The portfolio value growth was recorded at 10.79%. The growth potential was 12%, and the risk level dropped to 0.9%.

The structure of the investment portfolio "Optimal" as of October 10, 2024.

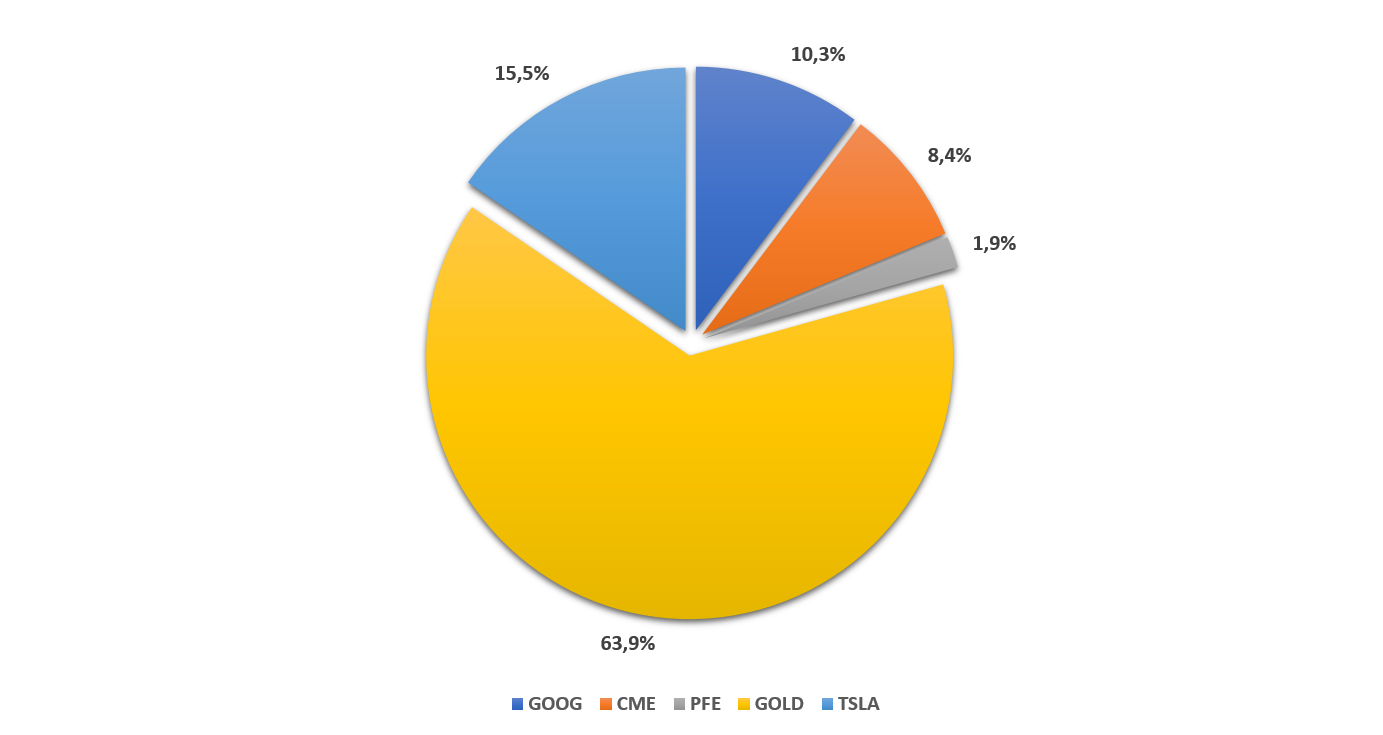

Investment Fund

The Esperio investment fund demonstrated growth of 11.1% as of the reporting date of October 9, 2024. Closed transactions in gold and NVidia shares brought in a profit of $1,572.29 and $1,262.50, respectively. The fund's investors received profit from dividends from shares of CME Group ($9.2), Google ($1) and NVidia ($0.5).

Taking into account the data of technical and fundamental analysis, current trends in the market, the fund manager decided to open transactions in gold at a price of $2,608.1 and Tesla shares at a price of $178.02. According to Esperio analysts, the growth of Tesla's financial and operational indicators will contribute to the movement of the leading electric vehicle manufacturer's share prices towards $280. The purchase price was $243.2.

The portfolio's growth potential is 13% with a risk level of 6.2%.

Esperio investment fund structure as of October 9, 2024.

The managers of the global broker Esperio develop investment portfolios, taking into account various strategies and accepted risk, and balance them in terms of the investment period and projected profit. Throughout the entire investment period, Esperio provides full transparency, regular monitoring of performance and rebalancing of portfolios to ensure the stated return and risk, as well as thorough analysis of the results. It also provides investors with detailed reports.